All professionals want to maintain a healthy work-life balance, but only few actually achieve that goal. The development of technology made everything more difficult. These days, some managers think that

All professionals want to maintain a healthy work-life balance, but only few actually achieve that goal. The development of technology made everything more difficult. These days, some managers think that

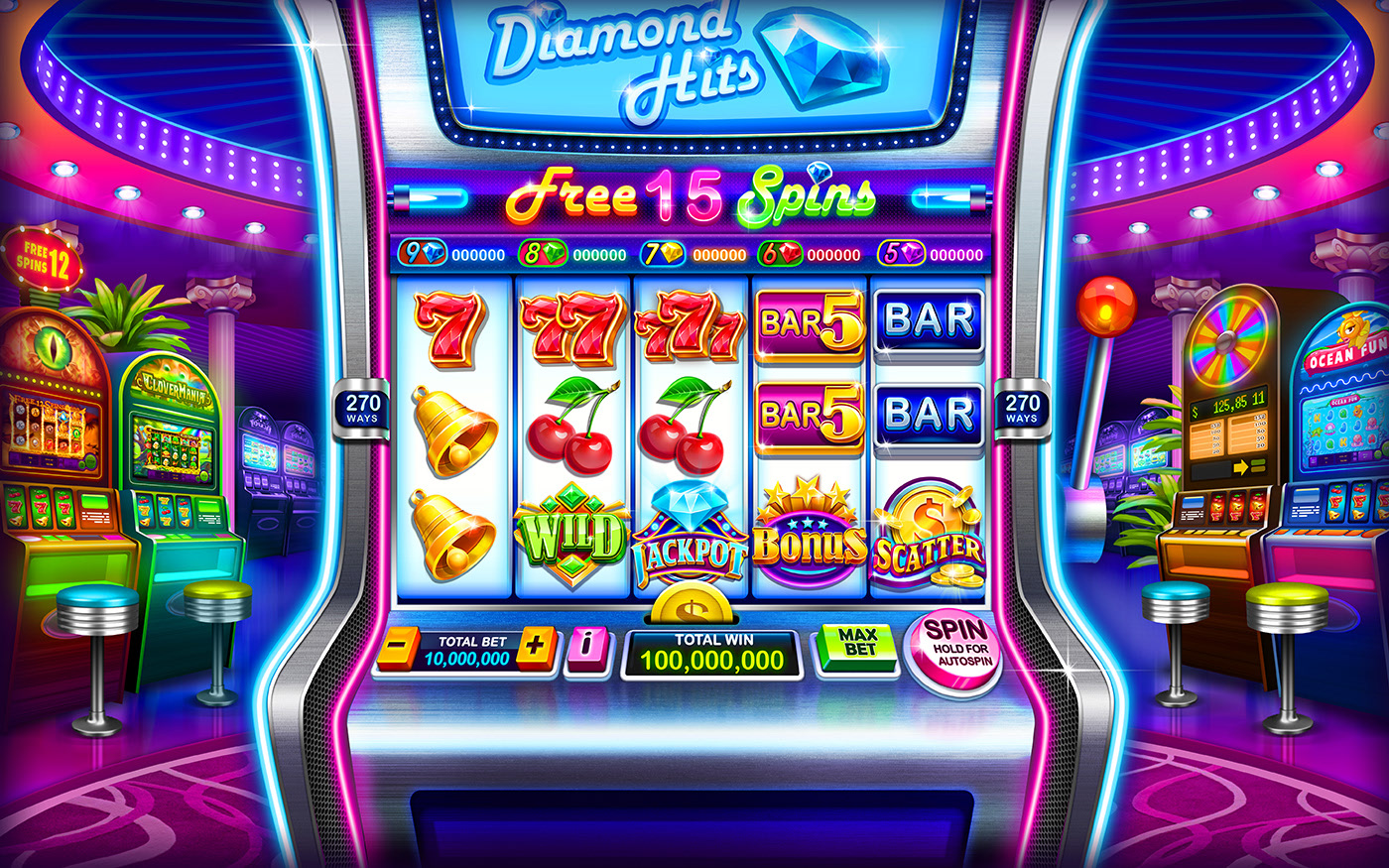

Slot machines are the popular casino games that almost every player loves to wager on. Whether you are an experienced player or a newbie, wagering on slot machines is quite

If you look through history, Poker has been played for centuries. And many players across the world have shown a stunning performance in it. Some of the biggest wins in

Here you can see the main reasons why the 20Bet Login casino is one of the best casinos. There are a lot of advantages for casino players. This information is

In 2007, 22Bet Kenya offered more than 1100 different kinds of games. As well as standard table and card games like baccarat and roulette, the casino also provides a wide

The total turnover in gambling in by the end of 2021 exceeded 2.262 trillion dollars. At the same time, the total income in the industry has exceeded 400 billion: about

Meaning of two concepts Gambling is a vertical in traffic arbitrage related to gambling and casinos. An offer in gambling is an online casino or a product that includes a

The gambling business was originally based on house edge – the percentage of profit of a gambling establishment in the long term and fair play implies a return of funds

Video slot is a creation of artists, programmers and mathematicians. Through complex calculations during the development phase, a quantitative characteristic called RTP (Return Rate) is calculated for each slot, which

Probabilities of mean values In gambling, it is important to roughly understand the possible profit. The mathematical expectation, which shows the average value of a random variable, helps with this.